All that needs to happen is for the market price of the stock to fall below the exercise price of the option. The options therefore represent a complete unknown.ĭue to market factors alone, there is always the risk of options becoming worthless, even with a well-established blue-chip company. Meanwhile, the fact that the event is not expected to take place for at least another year means that the stock doesn't even exist right now. And "rumored" means that whether or not the company will actually go public is still subject to some speculation. What makes those two words so dangerous? "Startup" implies that the employer is a new or fairly new company. The person asking the question describes the employer he or she's considering as a "well-known privately held startup rumored to go public in the next year/year-and-a-half." There are two red flags in that assessment: startup and rumored.

To preserve cash - options don't require out-of-pocket cash, like salaries do.There are several reasons why employers offer stock options: Why an employer would want to offer stock options If the options expire before that price is reached, they will become worthless. The options have no value unless the stock climbs to over $50. But the value of the company's stock has fallen to $40 per share. The employee exercises the options, and earns an immediate $5,000 profit - 200 shares at a gain of $25 per share.Īfter two years with the company, the employee is vested in another 200 shares. After one year, the employee is vested in 200 shares, and the share price has climbed to $75. And naturally that can never be known at the time the options are granted.įor example, an employer might grant an employee the option to purchase 1,000 shares of stock at $50 per share, which is referred to as the strike price, or exercise price. The market value of the stock at the time the options become vested determine the value of the options. Vesting is a strategy that employers use to keep employees with the company for longer periods of time. Vesting might occur over, say, five years.

Linkedin stock option full#

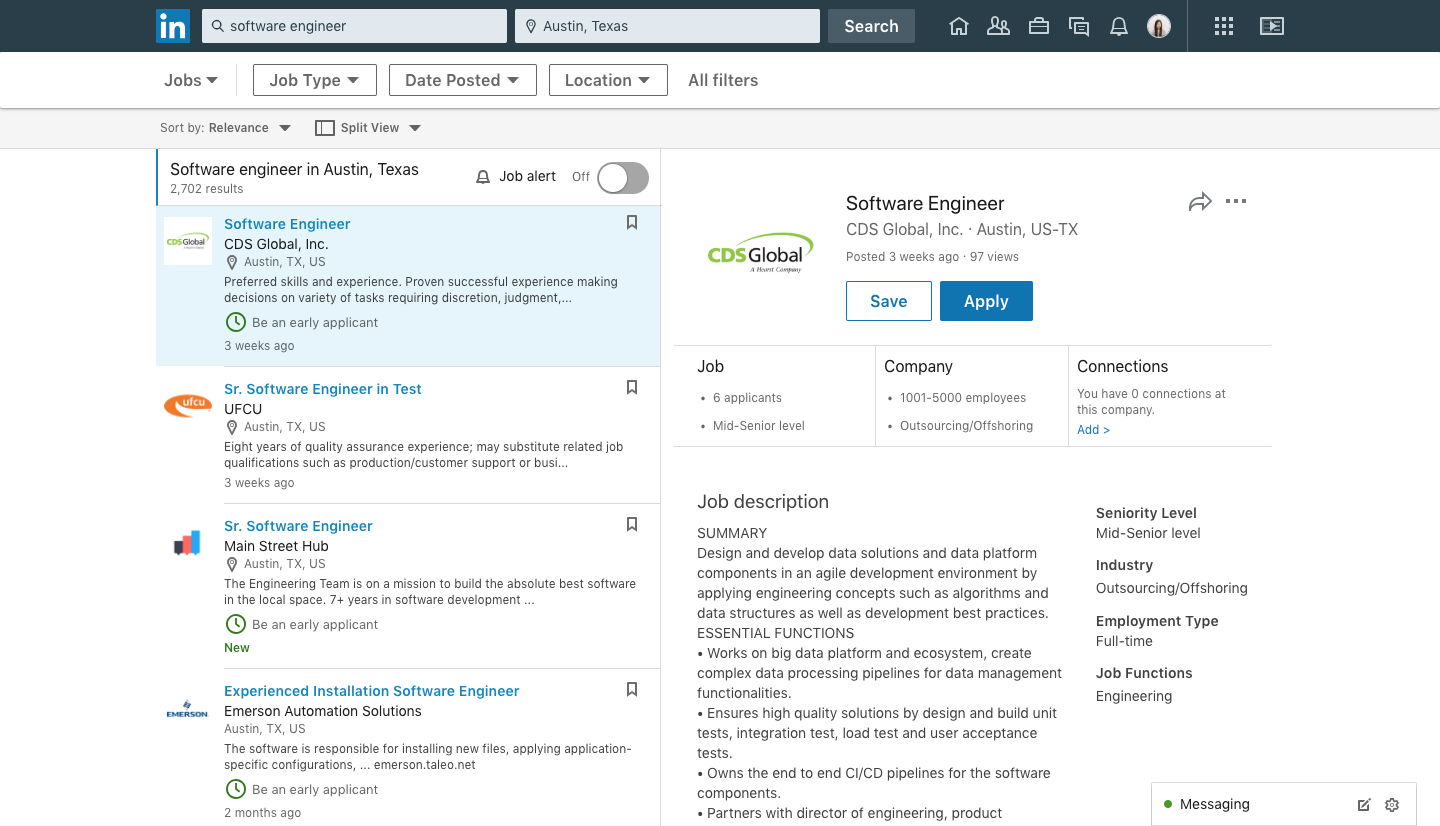

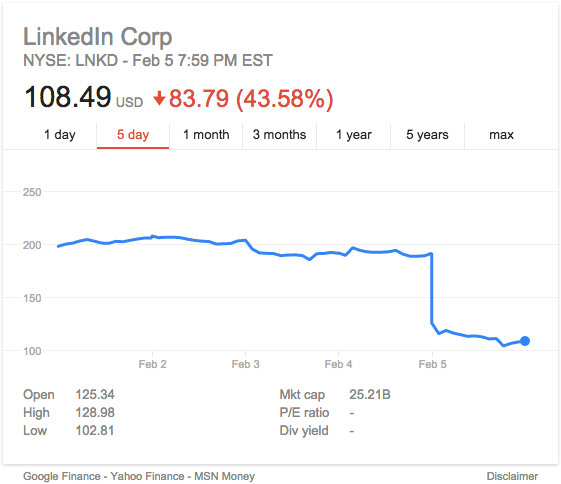

There is also a vesting period, after which the employee will have full ownership over the options. If the options are not exercised by those dates, the options will expire and become worthless. So that, of course, could be a catalyst for Microsoft going forward.Account icon An icon in the shape of a person's head and shoulders. They see that growth returning and getting stronger here over the next couple of years. Lots of, I guess, encouragement, positivity about AI, but even before we start to see that come to fruition, a lot of these notes mentioning their cloud business, Azure. We're seeing that carry into this week.Īnd Stifel also raising its price target on the stock. So Microsoft outperformed many of its tech peers last week. But it's interesting when it comes to Microsoft and a lot of the excitement that we have certainly seen on the Street. Well, you also have to think that that might be indicative of the job environment right now and where we might be headed over the next couple of months here. They laid off 10,000 people, Microsoft did last year. Again, that's just in from the information. This just in, though, from the information that Microsoft-owned LinkedIn is joining the parade of layoffs today in their recruiting department. They also said they couldn't tell me who the leader in AI is, other than Google, Amazon, Facebook, Microsoft, and Apple.īut you can see shares a big day today and up more than 13% this year. They couldn't tell me what Microsoft was going to go up. Chat apologized to me for not being able to predict stock prices with certainties.

Microsoft, of course, the subject of all the AI buzz in recent months, certainly from this mouth, announcing several weeks ago they'd invested $10 billion in Open AI's ChatGPT. A price target of 307 implies more than a 12% upside. Quote, "a setup of supportive shares moving higher," and Weiss has an overweight rating. Microsoft shares surging on a note from Morgan Stanley analyst Keith Weiss, writing, quote, "Near-term cyclical impacts create an attractive entry point into one of the best secular growth stories in tech." Weiss adding he models five straight quarters of accelerating growth in earnings per share off that December quarter. Video TranscriptĭAVE BRIGGS: My play is the biggest gainer in the Dow. The Yahoo Finance Live team discusses the latest analyst ratings for Microsoft and possible layoffs at LinkedIn.

0 kommentar(er)

0 kommentar(er)